blog cinnamon blog

- event

Overseas cutting-edge insurance DX trend webinar report revealed at “ITC Vegas 2021”

We held a seminar to introduce the latest insurtech trends and insights that appeared at Insure Tech Connect 2021 (hereinafter referred to as ITC Vegas 2021), one of the world's largest insurtech events held in Las Vegas, USA, last September. We will report on the content of the webinar.

(Reference) Download related materials

Dai-ichi Life Insurance Co., Ltd. implementation case report

Examples of AI introduction in the financial industry

How to use the latest AI technology

Cutting-edge overseas insurance DX trends revealed at “ITC Vegas 2021”

Date and time: Wednesday, November 24, 2021 15:30-17:00

Event format: Online (webinar)

Representative CEO Hirano said in his opening remarks, ``Currently, I feel that DX is progressing all over Japan, and I feel that the insurance industry is an industry where DX is very advanced.Digital is an important area within this. ” mentioned.

From here, we will introduce the highlights of ITC Vegas 2021 and notable insurtech cases.

Insure Tech Connect 2021 Highlights

Representative Director, Vice President and COO Yoshiaki Ieda

Insure Tech Connect is one of the world's largest insurtech events held in Las Vegas every September. Approximately 300 speakers, 2,300 companies, and 7,000 people gather each time. This year was the first time in two years that the event was held on-site.

There are a total of 8 tracks, including the main track and 7 other tracks, with discussions on various insurtech themes. Participating companies include famous insurance companies and insurtech players from around the world, including companies from Japan that have innovation hub organizations in North America (AIG, AXA, Prudential Financial, Zurich, Chubb, etc.) almost all participate.

We have been participating in the event since 2019, and this is the third time we have held a seminar to observe insurtech from a fixed point and provide a summary. In this seminar, we will share the latest trends from the overall track of events.

First, I will introduce the status of investment in insurtech companies.

According to Forrester Research, an American research company, there were 472 investments in insurtech companies around the world from July to September this year, with an investment amount of $530 million, an increase of 283% compared to the same period last year. We can see that investment in the system is growing. From January to December 2021, it is predicted that the investment will be $1.5 billion.

*Of the insurtech investments in the third quarter of 2021, 70% will be invested in the United States.

S&P Global also suggests that listed insurtech companies may become targets for M&A if their stock prices decline after going public. In fact, in November of this year, Lemonado announced that it would acquire Metromile, and it became a hot topic of conversation.

Introducing four overviews of ITC Vegas 2021

(1) There are no major changes from ITC 2019 in terms of technological novelty, but insurtech companies are entering a growth stage and increasing their presence in the market.

Insurtech has been gaining attention since around 2017, and it can be said that it has now reached a growth stage. With the emergence of mega players, business lines and functional expansion are progressing, and growth is expected to continue in the future.

Here are three distinctive examples of this.

① Acquisition of an insurtech company by an insurtech company

In November 2021, Lemonado announced that it would acquire Metromile, with the acquisition price said to be $500 million. Lemonade offers P2P pet insurance, life insurance, home contents insurance, and has recently started selling auto insurance, but due to licensing restrictions, it was only able to sell it in California.

Prior to that, Metromile sells mileage-based auto insurance in 49 states in the United States. Lemonade's acquisition of Metromile will instantly expand its auto insurance sales area to all of America.

*Both companies are affiliated with Tokio Marine Holdings.

②Further expansion of insurtech companies

Haven Life, a wholly owned subsidiary of Mass Mutual that sells life insurance completely online, sells term life insurance without requiring a medical exam and provides a customer experience that allows for speedy purchasing. Based on its strengths, the company has developed a SaaS platform that can automate processes from product development to underwriting and insurance claim applications, and has begun offering it to small and medium-sized insurance companies.

In this way, the trend was characterized by insurtech companies making full use of their own technology to expand their business lines.

③ Demonstrates great presence at insurtech events

Hippo, which provides home and property damage insurance online, is an insurtech company that uses AI and IoT sensors to minimize damage to policyholders.

For example, we use IoT to measure the temperature in the attic. At that time, if the temperature in a particular spot is high, sensors measure whether light may shine through and cause water leakage, which can help reduce disasters.

This year, the company went public through a special purpose acquisition company, increasing its presence in the market. Also, at ITC Vegas 2021, there were many employees wearing Hippo T-shirts throughout the venue, which became a hot topic. It was also impressive to see the presence of mega insurtech players at insurtech events.

*Hippo is affiliated with Mitsui Sumitomo Insurance.

(2) Improving the customer experience and leveraging technology in underwriting and claims remains a central theme, moving from the 'concept' to the 'implementation' stage.

This topic was talked about a lot in every session. Basically, consumers' needs continue to diversify and demands for a better insurance experience are irreversible, and the movement toward a smooth and convenient insurance experience is likely to accelerate in the future.

In addition, omnichannelization and personalization will continue to be central themes, and the key will be how to make advanced use of unstructured data (various data inside and outside the insurance company) and utilize it for product development. Masu.

(3) In the United States, with the spread of data utilization, new players are starting to emerge and specialize in risk targets.

Insurtech players have emerged to address emerging and specialized risks in the American insurance industry, and we will introduce two of them.

The first company is Cyber Fortress, which was founded in 2018 and provides parametric insurance that covers lost sales if your e-commerce site goes down due to some kind of failure. We set prices by integrating and segmenting risk models based on over 2000 characteristics. Causes of downtime include human error, service provider failure, and unauthorized access.

The second company is zesty.ai, which was founded in 2018 and provides a service that accurately predicts the risk of damage to buildings from natural disasters such as wildfires and floods. Utilizes over 150 million property data obtained from climate science and sanitary photography as learning data, classifies property-specific characteristics such as buildings and houses into over 65 categories, and further combines regional and property-specific data to predict damage. We provide a calculation service. The company provides data to non-life insurance companies, and is said to provide data to more than half of the top 100 non-life insurance companies in the United States.

(4) Many built-in insurance players have appeared, and there is much to learn from the customer experience perspective.

This year's ITC Vegas 2021 has been covered in many ways, and it continues to be one of the topics in insurtech.

However, the market size of built-in insurance is small, mainly for accident insurance and travel insurance, so it can be seen that the amount of attention it receives is limited. On the other hand, it is said that there is much to learn from not only a seamless insurance experience, but also the UX of the entire process from the first point of contact to purchase.

From these processes, built-in insurance has the potential to collect more customer data than ever before, and also functions as a fraud prevention measure.

Other subtopics include the following:

Introducing cutting-edge insurtech cases

Business Development Department Hiroki Hayashi

We will introduce case studies of non-life insurance from among the companies that actually gave presentations at ITC Vegas 2021.

[Non-life insurance] CLAIM GENIUS: Improving auto insurance assessment and payment operations

CLAIM GENIUS provides a loss assessment solution that leverages AI and CG technology for auto insurance providers. If you take an image of the vehicle involved in an accident with your smartphone and send it to us, we will calculate the cost and time required to check for damage, repair, and replace parts. Another feature is that uploaded images can be used to analyze not only external damage but also internal damage.

[Non-life insurance] Hosta AI: Improving the efficiency of underwriting and assessment of buildings and home contents insurance

Hosta AI, provided by Hosta Labs, evaluates the structure, area, materials, etc. of buildings and furniture from uploaded photos and creates 2D and 3D reports. Since damaged parts can also be detected, it is possible to obtain the information necessary for underwriting and appraisal operations all at once. By understanding data such as indoor spatial relationships and furniture materials, we enable more detailed and accurate underwriting and screening.

Business Development Department Manager Yohei Otsuka

Next, we will introduce cases closely related to "life insurance" and cases of "both life insurance and non-life insurance."

[Life insurance] Atidot: Promoting strategic use of held data

Atidot provides a cloud-based AI and predictive analytics platform for life insurance companies. Most of the data held by insurance companies is not effectively utilized, and enriching it with external data sources will improve target selection for product upsell and cross-sell, premium sustainability, and surrender and lapse rates. etc. can be predicted.

[Life insurance/non-life insurance] Shift Technology: Fraud detection and automation in appraisal operations

Shift Technology provides insurance companies with automation solutions for the underwriting process, with a focus on fraud detection during underwriting and payment assessment. AI can be used to analyze similar insurance claim information, SNS analysis, and cross-sectional analysis of seemingly unrelated claim data, making it possible to respond to the increased risk of fraud due to payment automation.

[Life insurance/Non-life insurance] Zelros: Sophistication of customer front operations

Zelros provides insurance companies with an AI business platform specialized in insurance, utilizing structured and unstructured data such as voice and various documents. It's like a CRM, managing contract details and information on a customer-by-customer basis, and advising sales and CS personnel on recommended actions in real time. It is also possible to create sales flows and learning paths tailored to the level of the person in charge.

Representative Director, President and CEO Mirai Hirano

“Up until now, we have supported multiple companies in their digitalization and DX (growth strategies), and each company has been involved in various phases, from ``considering the introduction of AI'' to ``growth strategies using AI.'' , and Cinnamon AI consistently supports them."

The webinar will introduce usage scenarios and implementation examples of AI in the insurance field. We also touched on the short-term theme ideas for AI that will improve the insurance customer experience and how we are thinking about the medium- to long-term vision.

Cinnamon AI already provides products to multiple insurance companies.

In March 2021, we jointly developed an AI system for automatic assessment of insurance claim documents with Sompo Japan. We have introduced it to smartphone-based medical insurance provided by Sompo Japan.

Additionally, in August, we supported NN Life in automating the reading and data conversion of non-standard forms using AI-OCR. Furthermore, in November, we jointly developed the AI image recognition (automatic insurance policy reading) function that is being introduced in the new automobile insurance "&e" newly released by E-Design Insurance.

Most recently, in January of this year, we have provided a wide range of support using AI, including jointly developing the AI image recognition (automatic insurance policy reading) function introduced in &e, a new automobile insurance company newly released by E-Design General Insurance. It is expanding.

■Please check each news release here.

- Sumitomo Life (January 2022)

- E-design Insurance (November 2021)

- NNN Life (August 2021)

- Sompo Japan (March 2021)

<Related materials download>

Dai-ichi Life Insurance Co., Ltd. implementation case report

Examples of AI introduction in the financial industry

How to use the latest AI technology

In addition to these seminars, Cinnamon AI also holds regular seminars.

To applyhereThank you for your understanding. If you have any other questions regarding this article or would like to discuss business, please contact us.herePlease feel free to contact us.

Recommended articles

-

event

event -

event

eventOverseas cutting-edge insurance DX trend web revealed at “ITC Vegas 2021”…

Overseas cutting-edge insurance DX trend webinar revealed at “ITC Vegas 2021”…

-

event

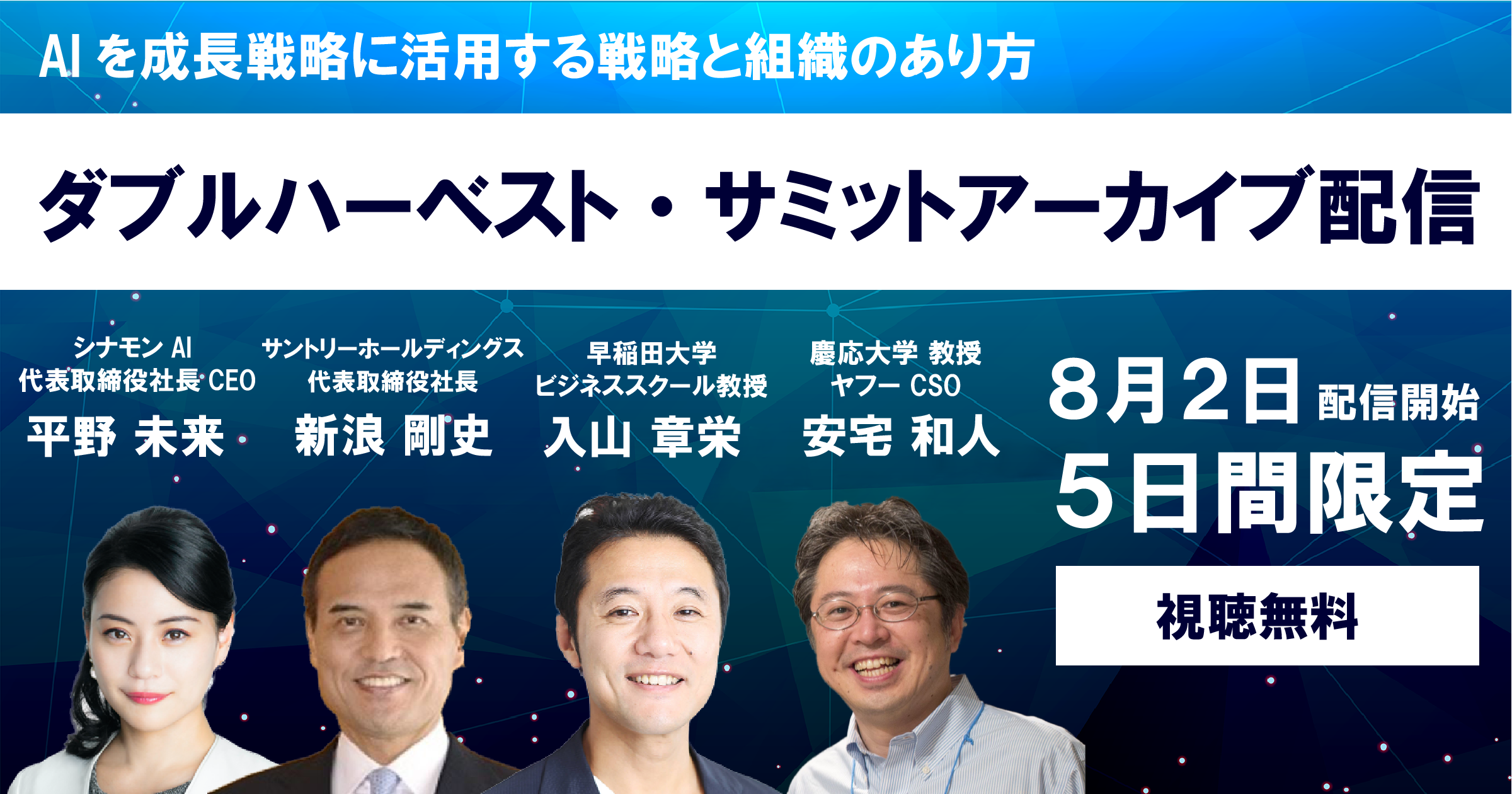

event[5 days only] Double Harvest Summit, archive distribution public page

[5 days only] Double Harvest Summit, archive distribution public page