blog cinnamon blog

- technology

Insurtech, the forefront of insurance industry DX

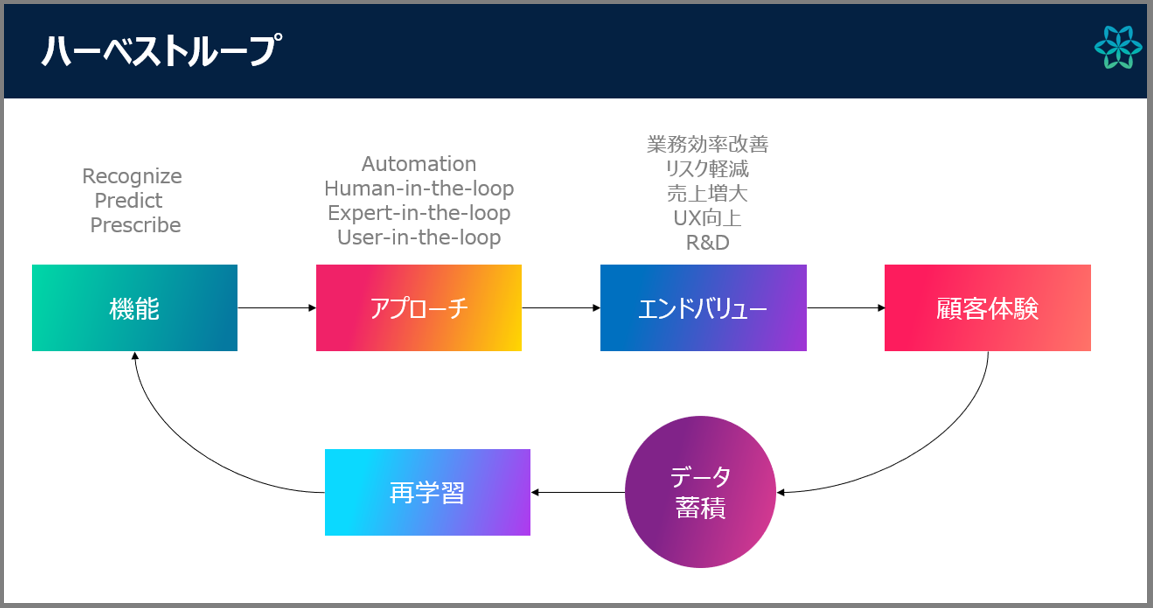

■Five end values proposed by the AI utilization strategy “Harvest Loop”

How does your industry or company view DX (digital transformation)?

In our case, we define DX as ``creating new value, services, and business models by implementing business and organizational reform, awareness and system reform from a management perspective.'' Therefore, as an important concept for promoting DX, we are proposing a form of strategic design for the AI era called the "Harvest Loop."

This term refers to the ideal cycle in AI utilization, where accumulated learning data is provided as a customer experience while gaining end value, which in turn generates new learning data. Here, we classify the end value of AI utilization into five categories: "improvement of operational efficiency," "risk reduction," "increase in sales," "improvement of UX," and "R&D," and focus on which of these values to provide. doing.

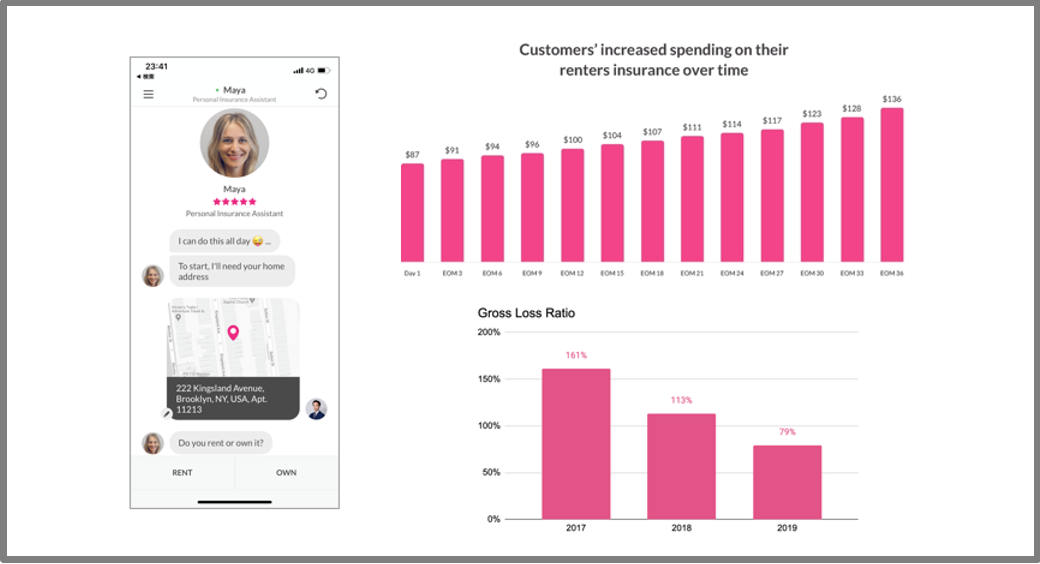

For example, in the case of Lemonade, an American online non-life insurance company, which we have previously introduced on this blog. Lemonade is a growing company that has introduced an AI chatbot called Maya and developed a system that allows for easy membership procedures using just an app, and has reached a market capitalization of approximately 460 billion yen in just 5 years since its establishment.

If you check the company's Gross Loss Ratio (*an indicator that indicates the management efficiency of an insurance company) so far, it is 161% as of 2017. This shows that while the insurance premium was 100 million yen, there was a payment of 161 million yen. In other words, a large deficit.

However, Lemonade has steadily reduced the loss ratio by accumulating a variety of data without wasting it. For example, the risk of water leaks in water supply and drainage equipment is calculated from the age of the insured building. Or the risk of fire or earthquake from the durability of the structure. Furthermore, various data is incorporated into the AI, such as determining the risk of inflammation in the event of a fire in the area, based on the distance to the fire department.

As a result, the Gross Loss Ratio was 113% in 2018 and 79% in 2019, successfully achieving early profitability. This can be described as overwhelming growth potential.

So, what is the end value that Lemonade provides? When applied to the harvest loop, the corresponding end value is "UX improvement." In other words, it is a model that removes (improves) the inconveniences inherent in the experience of purchasing insurance.

As a result of collecting data and repeatedly relearning, customers are now able to experience an overwhelmingly speedy and simple purchasing process, which leads to their next purchase behavior. And by collecting that data in Lemonade, the AI will be further strengthened.

Initially, data handling cannot be completely left to AI and will require the help of specialized personnel as it learns, but after a certain point the accuracy of AI will greatly increase and AI will become more efficient and competitive. One of the characteristics of using AI is that it can be improved.

■Data moves from the “hunting era” to the “agricultural era”

An AI utilization strategy can be organized into three steps: "obtaining end value," then "transforming into a transformation strategy," and finally "strengthening it as a sustainable harvest loop." .

Even if it is difficult to implement AI right away, as long as you accumulate data, you can improve your competitiveness later. In order to utilize these models, it is important to have a mindset of "harvesting" data that naturally comes together, rather than the traditional mindset of "hunting" data. In that sense, it can be said that data collection for AI utilization strategies has moved from the ``hunting era'' to the ``agricultural era.''

■Latest examples of AI utilization in the insurance industry

Let's introduce some more recent examples of AI utilization in the insurance industry.

First is the case of "Claim Genius," which provides insurance application solutions for automobile insurance companies. By sending images of vehicles involved in accidents from smartphones, we have succeeded in halving the time and cost required for insurance claim assessments and payments.

When applied to the five end values mentioned above, the applicable one is "improvement of operational efficiency." By streamlining the procedures required to apply for insurance claims, you can free up resources for higher value-added work and speed up payments to customers. As a result, the number of subscribers will increase further, and as more accident data is collected, the AI will be strengthened, so it can be said that it is the ideal form of a harvest loop.

Life insurance company Ladder has successfully shortened the insurance application process, which takes about six weeks on average in the industry, to just a few minutes using AI. For example, you can sign up by answering a few questions, such as your mortgage balance and whether you have children, and the design is simple, allowing you to choose from 10, 15, 20, 25, or 30 years. If you are seeking $500,000 in coverage over a 20-year policy period, the UX will instantly tell you that you will need to pay $21.54 per month.

The target audience for this model is the millennial generation in Japan. Ladder has a huge following among young people who want to buy life insurance but are put off by the cost and complexity of traditional insurance products.

In other words, the relevant end value is "improved UX." In addition to reducing the time and effort required to apply for insurance, making the process simple and speedy, it also makes it possible for anyone to purchase personalized insurance products. As a result, a harvest loop is completed that achieves high customer satisfaction, and the AI continues to learn.

Finally, Flyreel, which provides home insurance enrollment navigation, is a company that provides AI solutions that collect data about users' homes and identify important information and risks related to insurance contracts.

The relevant end value is "improvement of operational efficiency." Home insurance originally requires not only the exchange of documents, but also an on-site inspection in some cases. At Flyreel, we use image recognition and AI assistants to efficiently collect the necessary data. As a result, procedures on the customer side have been simplified and it has become possible to propose insurance products based on more detailed data than before.

In either case, the key is to utilize "Unstructured Data", that is, unstructured data. Anyone can easily obtain "structured data" whose type is determined based on a database. That's why the use of unstructured data such as natural language and videos can lead to differentiation.

Of course, there are currently various regulations in place in the Japanese insurance industry, so these models cannot necessarily be imitated right away. However, there are many things we can learn from this as a precedent example for AI utilization strategies. Please use this as a reference when considering a harvest loop for promoting DX.

Yoshiaki Ieda, Executive Vice President, Cinnamon AI Joined Cinnamon after working at Dentsu, Recruit, P&G Singapore, and starting a business. Based on his extensive experience in launching new businesses, he is in charge of new business consulting and product/service design. Bridging business requirements and technical solutions. Yoshiaki Ieda, Executive Vice President, Cinnamon AI Joined Cinnamon after working at Dentsu, Recruit, P&G Singapore, and starting a business. Based on his extensive experience in launching new businesses, he is in charge of new business consulting and product/service design. Bridging business requirements and technical solutions. |

At Cinnamon AI, we help companies utilize AI and promote work style reform through consulting, workshops, and solutions. We would appreciate it if you could feel free to contact us.

Click here to contact us => Inquiry form