blog cinnamon blog

- event

The definitive reason why ventures with a market capitalization of over 1 trillion yen do not grow in Japan [Guest: Akira Iriyama] (Part 1)

*This article is reprinted with permission from Diamond Online.

As co-founders of "Cinnamon AI," which provides AI solutions to many companies, Hajime Hotta, who promotes DX in Japan, and Kazuhiro Ohara, who leads the Japanese IT industry with numerous bestsellers, have teamed up. ``Double Harvest: Strategic Design in the AI Era to Create a System that Continues to Win'' became the number one business book on Amazon immediately after its release, and has received rave reviews from top runners in various industries.

This time's talk will feature Professor Akie Iriyama of Waseda University Business School, who has made a passionate comment about Double Harvest, saying, ``This is a practical book that systematizes AI and business that all managers should read!'' I invite you to

Why is the use of AI not progressing in Japan? How should I set the purpose that is the premise for running the "Harvest Loop"? We asked author Mr. Hotta and Mirai Hirano, representative of Cinnamon AI, about obstacles when promoting DX and specific measures to overcome them (part 1/all 3 parts, composed by Yukihiro Tanaka).

Hajime Hotta (hereinafter referred to as Hotta)Today, we have invited Professor Iriyama from Waseda University to speak with Mr. Hirano, the representative of Cinnamon AI. Thank you for your continued support today.

Akira Iriyama (hereinafter referred to as Iriyama)This is Iriyama from Waseda University. 『double harvestI am happy that this book has come out because I am good friends with Kazuhiko Tomiyama, Kazuto Ataka, and co-author Kazuhiro Ohara, who wrote recommendations for the book.

I'm a professor at Waseda University's business school, but recently I've been working as a director at various companies and consulting with business owners, so I spend more than half of my time working there. I use it for. Of course, I also work as a researcher, so I am constantly going back and forth between theory and practice. Mr. Hirano came to our business school and spoke twice in front of working students.

Mirai Hirano (hereinafter referred to as Hirano)My name is Hirano and I am the representative of Cinnamon AI. Personally, AI and entrepreneurship are my two main interests, and more than 15 years ago, I was researching artificial intelligence at university. I started my own business when I was a student and sold my first company to mixi, but since then I have been building an AI business while connecting Japan with Asian countries such as Singapore, Vietnam, and Taiwan.

Akie Iriyama

Professor, Waseda University Business School

Graduated from Keio University Faculty of Economics in 1996. Completed master's program at the same university's Graduate School of Economics in 1998. After working at Mitsubishi Research Institute, where he primarily engaged in research and consulting for automobile manufacturers and domestic and international government agencies, he left the company in 2003 and entered the doctoral program at the University of Pittsburgh Graduate School of Business. Obtained a Ph.D. from the same graduate school in 2008. In the same year, he became an assistant professor at the School of Business at the State University of New York at Buffalo. Became associate professor at Waseda University Business School in 2013, current position since April 2019. Specializes in business strategy theory and international management theory. In his book “World standard management theory” (Diamond Inc.) etc.

Without purpose, DX will not be successful

HottaRight away, ``double harvestWhat did you think after reading it?

Entering the mountainI think it's a really good book, without any pretense. I am an outside director at several companies, including Sanoh Industries and Rohto Pharmaceutical, both of which are primary automotive suppliers, so I would like all of their presidents and executives to read it.

Up until now, books on AI have mainly been collections of case studies, such as how the United States and China are amazing and how technology works, but instead focus on what can be done using AI tools and how to create and harvest new value. I don't think there has ever been a book that organizes this in a way that connects it with business. For the first time, I saw a diagram that organized the value realized by AI based on the axis of automation and human-in-the-loop, and when I heard about the double loop, it made sense, so I learned a lot. .

As written in this book, AI has become a commodity, and the question is how to make full use of it. When I've recently been asked to give a lecture on the topic of DX, the first thing I say is that digital is not an end, but a means.

HottaIt's important.

Entering the mountainHowever, there are still many people who misunderstand DX as a magic wand. There are many companies that think, ``If we digitize and introduce AI, something good will come out, right?'' This is what global IT companies that are trying to introduce AI to Japanese companies are also worried about.

But the important thing is, what does your company want to do in the first place? This is a question that would be easy to answer if you are a venture company, but if you are a large legacy company, it is difficult to get a clear answer. I think there are many customers like that.

plainI agree. Even if you look at a company's homepage, there are cases where there is nothing written about these points.

Entering the mountainAs Mr. Hotta writes in his "Afterword," what is important is the purpose. If there is a purpose first, many ideas will come up about how to use AI as a means to that end. However, since there is no purpose, it becomes very difficult to incorporate digital technology. The degree of empathy and enthusiasm for the future and purpose and the degree of progress in DX and transformation are one set.

DX will advance if there is empathy for the purpose throughout the company and if there is digital technology. If your company has not yet progressed in digitalization, but you have a purpose, you can go ahead. However, traditional Japanese companies do not have both. If such a company tries to just add AI without having a purpose, it will definitely lead to confusion.

HottaThere are many stories like this all around us. I would like all kinds of companies to create harvest loops and promote DX, but even if there was a theory like this, I feel it would be difficult to turn it into a movement, especially within large companies. Professor Iriyama, there are various problems such as having to persuade various people within the company and a gap between the workplace and management, but how do you think this can be overcome?

Hajime Hotta

Cinnamon Co., Ltd. Executive Officer/Futurist

Born in 1982. Since his student days, he has been consistently engaged in artificial intelligence research such as neural networks, and at the age of 25 completed the doctoral program at Keio University Graduate School of Science and Engineering (Doctor of Engineering). Selected for the "IPA Unexplored Software Creation Project" in 2005 and 2006. Joined Sirius Technologies in 2005 and was responsible for the development of AdLocal, a location-based advertising distribution system. After founding Naked Technology while in school, he sold the company to mixi. Furthermore, he co-founded Cinnamon AI, the hottest AI startup that provides artificial intelligence business solutions such as AI-OCR, speech recognition, and natural language processing (NLP). Currently, he is active as a futurist at the company and is in a position to lead talented engineers in Southeast Asia. In addition, based on our philosophy of ``continuing to be an ally of innovators,'' we also provide advisory and coaching sessions for managers and leaders. While referring to the knowledge of cognitive science, we are exploring methodologies to increase the effectiveness of people and organizations. Lives in Malaysia. 『double harvest' is his first book.

Once the coronavirus is over, executives should go to Silicon Valley and China

Entering the mountainThe biggest key is management. Managers don't need to be computer scientists or people who are extremely knowledgeable about digital, but digital is the tool that changes the entire company and creates new value, and if you use digital, you can It is important that managers have a sense that they can realize their company's purpose. If you give it a little budget and try out "AI Nanchara", maybe something will come out? If you just think about it lightly, nothing will come out of it.

It is essential that managers have a strong sense of crisis that the company will not survive unless it changes and creates new value. Unfortunately, many companies did not have this sense of crisis before the coronavirus, but their awareness of this has changed considerably since the coronavirus. Once the coronavirus is over, I think all managers should go to Silicon Valley and China.

HottaI see.

Entering the mountainWhen you're in Japan, you don't get a real sense of how much destructive power AI has and how big of a change it will bring, but when you go there, you can see it even if you don't like it. This is a story I heard from someone, so I don't know how true or false it is, but Toyota's president Akio Toyoda went to Silicon Valley to invest heavily in AI, including establishing an AI research institute. It is said that this is because when he went there, he experienced a chill running down his spine when he saw that all the cars driving around the city were Teslas. There is a sense of danger that if things continue like this, everything will be replaced by Tesla, which is why we are able to make such a huge investment.

HottaI think a sense of realism is important. Even if you look at a consultant's report that tells you how this company is doing things, if you don't have a sense of reality, you won't be able to make decisions. This is because there is no part that is moved by emotion. In that sense, I think it's important to actually go there and see it with your own eyes.

Entering the mountainthat's right. As a side note, since I am a faculty member at a business school, I also have to think about the management of the business school. Everyone then looks at Keio and Hitotsubashi in the same country, but the real threat lies elsewhere.

I think online salons are now the biggest competitor to business schools. In other words, business school knowledge becomes a digital commodity and anyone can obtain it. If we can no longer differentiate ourselves based on knowledge itself, there will be value in saying, ``I want to meet this person'' or ``I want to consult with this teacher.'' If you do it digitally, it's the same as an online salon.

I myself run online salons, and I also participate in the salons run by the managers around me and see what's going on, so I understand this. That's why it's important to go to various places and experience the realism of the workplace, and to have a sense of crisis that if we don't change, we will be in danger.

This is not the time to be satisfied with being listed on Mothers.

plainIt's true that large companies lack a sense of crisis, but I actually think that startups also lack a sense of crisis. There are about 40 Japanese startups with a market capitalization of 100 billion yen, including Mothers' unicorns, but there are very few companies with a market capitalization of 1 trillion yen. About three companies: Rakuten, ZOZO, and CyberAgent. Compared to America and China, it is far too small. What should we do to increase the number of 1 trillion yen companies?

Entering the mountainI completely agree with you, and I also have a strong sense of the issue. I'm saying, ``Why don't we dismantle Mothers?''

HottaOooh.

Entering the mountainIn April 2022, the TSE will be reorganized into three markets: Standard, Prime, and Growth, and I think things will improve somewhat, but at least there is no point in going with the current lax listing standards. Why would you list a venture company with sales of 1 billion or 2 billion yen and a market capitalization of about 10 billion yen? Of course, venture companies that go all the way to listing are amazing, and I have a lot of respect for them, but it is also true that listing is easier in Japan than in other countries. As a result, venture companies do not aim to go global. The Japanese startup ecosystem is closed domestically, so they don't try to compete globally.

It's not just me saying this; some of Japan's leading venture capitalists also say similar things.

In fact, I get consulted from time to time, and people say, ``Mr. Iriyama, we're thinking about going public soon,'' and I ask, ``What's the series (stage of fundraising)?'' and he says, ``C.'' I was surprised to hear the answer. Even though WeWork is Series H, it hasn't even gone public yet.

Of course, when you get to Series C level, you can understand that there will be pressure from investors. Investors who came in at the later stage want to lock in their profits, so they ask us to go public. I know that there are investors who say things like, ``Don't go global, you won't be able to win anyway.'' Although this is not the case in all cases, such unfortunate things are happening in some cases, and I personally think it is a great waste.

Miku HiranoPhoto: Bottom left

Cinnamon AI representative

Serial entrepreneur. Completed graduate school at the University of Tokyo. Engaged in research on recommendation engines, complex networks, clustering, etc. It was twice selected for the IPA Unexplored Software Creation Project in 2005 and 2006. Founded Naked Technology while still in school. Develops and operates middleware that allows you to develop apps on iOS/Android/flip phones. In 2011, the company was sold to Mixi. She has received many awards both domestically and internationally, including ST.GALLEN SYMPOSIUM LEADERS OF TOMORROW, FORBES JAPAN "Entrepreneur Ranking 2020" BEST10, Woman of the Year 2019 Innovative Entrepreneur Award, VEUVE CLICQUOT BUSINESS WOMAN AWARD 2019 NEW GENERATION AWARD. He has also given a keynote speech at AWS SUMMIT 2019, Milken Institute Japan Symposium, 45th Japan-ASEAN Management Conference, Bloomberg THE YEAR AHEAD Summit 2019, etc. Since 2020, he has been appointed as a member of the Cabinet Secretariat IT Strategy Office and a special member of the Cabinet Office Tax Investigation Committee. From 2021, he will serve as an expert member of the Cabinet Office's Economic and Fiscal Policy Council. In her private life, she is a mother of two children.

Domestic market is extremely small compared to the world market

Entering the mountainWhy are Japanese companies' market capitalization rankings so low compared to America's GAFA and China's BAT? One reason is simple: the potential market is small. More than 30 years ago, in 1989, the top market capitalizations were dominated by Japanese companies. At that time, emerging countries had not yet developed and there was no single EU market. China is still a developing country, and the end of the Cold War between East and West means that globalization will continue to advance rapidly. That's why we were able to become the world leader just by capturing the Japanese market, which has the second largest GDP in the world. That's why NTT was ranked number one.

However, over the past 30 years, the world has changed dramatically. As markets have globalized and emerging markets have emerged, the potential global market has become larger. The United States originally has a population of over 300 million people, and if you win in the United States, you can capture the English-speaking market, so the total addressable market (TAM: maximum market size that can be captured) is about 2 billion people. China has a population of 1.4 billion, and the EU has a population of 750 million. Africa's population is 1.2 billion, India's 1.36 billion, and Southeast Asia's 660 million. In comparison, the Japanese market of 120 million people is extremely small. This is no match.

Although the countries in Southeast Asia are different, companies such as ride-hailing apps Grab and Gojek, and gaming, e-commerce, and fintech conglomerates Cee look at Southeast Asia from a complete perspective.

HottaI agree.

Entering the mountainIn addition to the fact that the Japanese market is hopelessly small, the fact that it is so easy to list on Mothers is itself a problem. What will happen if listing standards are tightened is that more M&A will occur as a means of exit. This is actually the case in America.

What are the benefits when a startup is acquired by a large company through M&A? The difference with listing is that once the lock-up (predetermined period of restraint) is over, the president of the company usually resigns. Big companies are boring. Then, since you have money in hand, you can aim for a bigger business the second time. He is a so-called serial entrepreneur.

Elon Musk is a typical example of this, and the second, third, and fourth companies suddenly become big. However, in Japan, companies can easily be listed on Mothers, so it is difficult to change the president. The current situation is that people stay at the same company for a long time.

HottaI totally understand.

Entering the mountainOf course, I respect everyone who runs venture businesses, so I don't think it's a problem with them, but rather with the Japanese system itself.

HottaFrom the perspective of a venture, there is the pressure of going public, and there is the problem that profits will inevitably decline if you expand globally, given the constraints of having to continue producing results even after going public. As a result, I feel that I will never be allowed to make decisions about expanding overseas. In order to push that forward and go overseas, a venture capitalist with an understanding of this would have to come on board, which I think is a high hurdle.

Entering the mountainHowever, some VCs and major companies that are aware of this are beginning to provide such support. For example, Hay, which operates the online shop opening support service STORES, has received new investment from Bain Capital. Hay is already at a level where it can be listed, but it seems that he wants it to do even better and to increase its market capitalization further before becoming a unicorn. There is an opportunity to do this, so I hope they will make good use of these people. What is also important is the president's courage, or rather his strong desire to persevere and conquer the world.

Reprinted from: Diamond Online / Akira Iriyama https://diamond.jp/articles/-/269476

"Double Harvest"

Book details and publicationhereYou can check from here.

Continued to the middle part:How to avoid turning your purpose and vision into “picture-filled rice cakes” [Guest: Akira Iriyama] (Part 2)

Recommended articles

-

event

event -

event

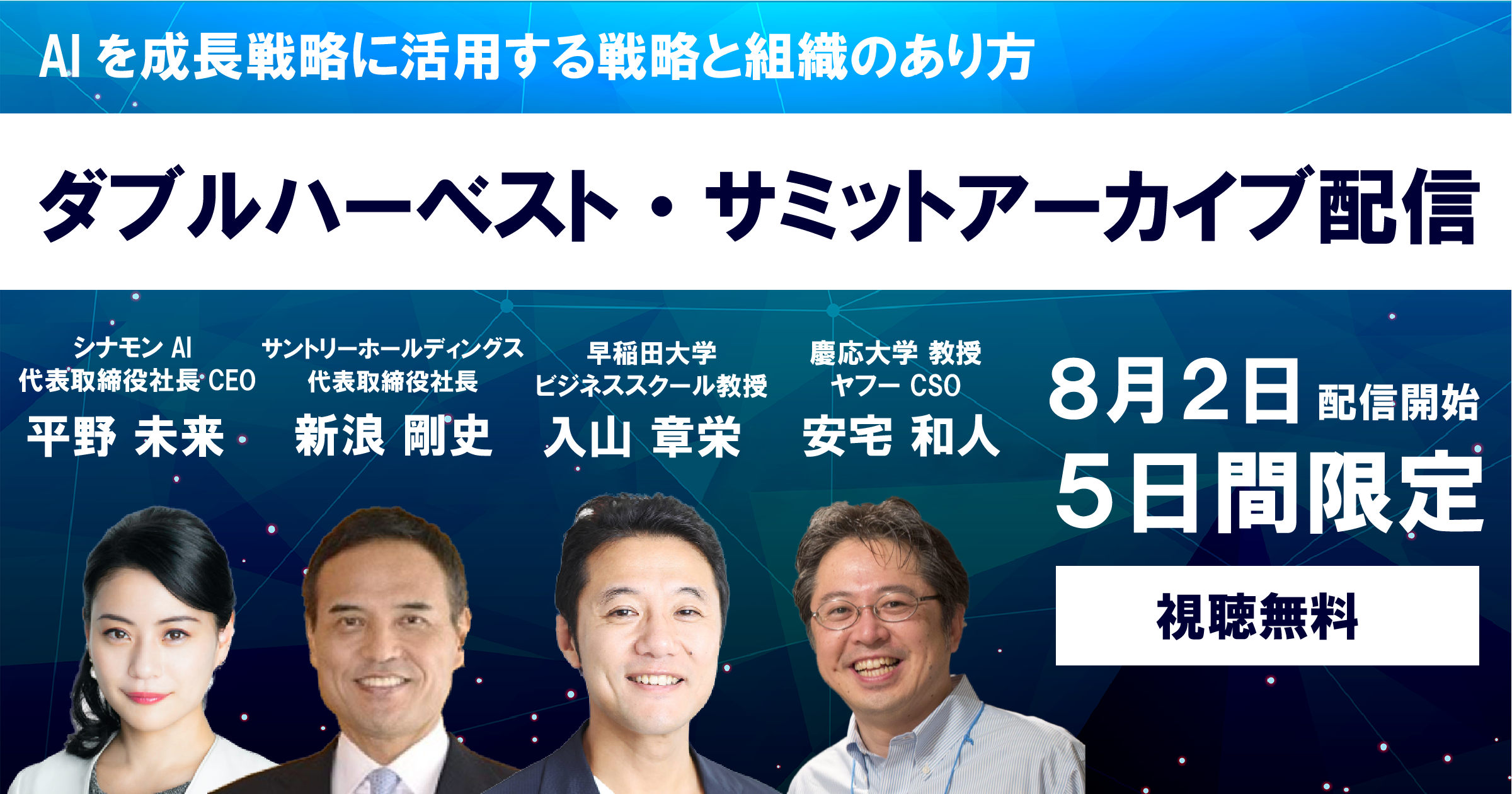

event[5 days only] Double Harvest Summit, archive distribution public page

[5 days only] Double Harvest Summit, archive distribution public page

-

event

eventA perspective that companies lack, saying, “We have data, but we don’t know how to use it.”

A perspective that companies lack: “We have data, but we don’t know how to use it.”