- insurance

Speeding up the underwriting process reduces the average time from 2-3 business days to as little as 3 minutes

NN Life Insurance Co., Ltd.- AI-OCR

business challenges

Previously, in medical assessments for insurance underwriting operations, we received documents such as health examination results reports and medical checkup results sheets from customers by mail, and the person in charge visually checked each item and converted it into data by hand. These tasks, which rely on mail and manual labor, have become a bottleneck in speeding up the application process.

Deployment solution

AI-OCR for the insurance industry

Solution features

- Digitize medical documents that are highly complex and have a large number of items with high precision

- Equipped with AI to check the quality of images taken by the camera

- Automate medical assessment itself by combining machine learning models and rule engines

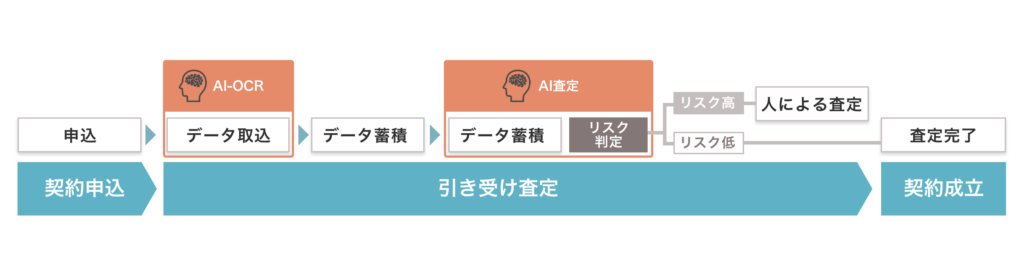

Image of assessment work using AI without human intervention

Benefits

By reducing the hassle of mailing and manual data entry, the membership application process has been made faster. The process, which previously took an average of 2-3 business days, has now been shortened to just 3 minutes. Using AI to check the quality of camera-captured images, we are now able to immediately send images back to the customer (retake), leading to even greater operational efficiency and an improved customer experience.

contact contact

Consultation, questions, etc.

Please feel free to contact us.